Bitcoin is unique

Bitcoin as a monetary instrument is unique: its strictly scarce (there will never be more than 21 million bitcoins) and simple to verify (no need to trust anyone not to lie to you).

Let’s take a close look at why these are relevant to you.

Strict scarcity

Money is no good if circulation can be increased at will. Imagine using a specific item as money, just to have someone discover a way to produce it at will and flood the market with it. This is what happened in Africa when natives used beads of natural origin as money, and European settlers flooded the market with glass beads (you can read more in Shelling Out by Nick Szabo).

In a less obvious way, that’s also what we currently see, with central banks printing massive amounts of US dollars and Euros at will. Since the financial crisis in 2008, the broad USD money supply (M2) tripled from about 7.5 trillion to now over 21 trillion USD. Two-thirds of all US dollars in circulation have been created since then. Of course, this devalues all dollars already in existence, and it’s puzzling how economists can be surprised that inflation has now finally caught up with them.

This modern form of money is called “fiat money” (from Latin: fiat, “let it be done”). It’s not backed by anything, and it only has value because the government says so, with people trusting that this will remain the case in the future. If that trust is broken, e.g., by excessive money printing, this type of money loses value very quickly.

Bitcoin, in contrast, cannot be inflated at will. It is the only monetary asset with certainty about how much of it will be in existence in 5, 10, or even 50 years. New bitcoin are created according to a strict schedule and protected by every network participant.

It might just be that Bitcoin is the most scarce and predictable asset that ever existed.

Simple verification

Now, all the scarcity is moot if you need to rely on someone else to assure you that this is really the case. If the system itself relies on a trusted third party, you can be lied to on just about everything. Only a decentralized system that allows you to verify its integrity yourself can be trustless.

You can’t even begin to verify the traditional monetary system yourself, with all its different opaque institutions and decision-making processes.

Legend has it that gold became so popular because it was easy to verify due to its weight and softness (think of pirates biting gold coins). This method is undoubtedly no longer good enough, but it still holds that the physical integrity of each unit can be tested, at least by specialists. It’s also somewhat known how much gold currently exists, but it’s a fact that not all paper claims on gold (through ETFs, gold contracts, futures, options) are fully backed. The estimated ratio of physical gold to paper gold ranges from 1:10 to more than 1:200. And while the exact number is not important, it’s telling that we simply can’t know for sure.

Bitcoin, in contrast, is a monetary asset with a built-in financial system. It’s fully open-source, and you can verify all aspects of it without asking anyone. Start from the source code, compile it to a computer application, connect to the peer-to-peer network, and verify every block and transaction that ever occurred since the genesis block. With this, you’re now a full participant in the first open and permissionless financial system that stood the test of time and lets you:

- verify the monetary schedule and the overall supply cap of 21 million bitcoin,

- verify that all past transactions adhered to the rules of Bitcoin, e.g., nobody spent their bitcoin twice, and

- verify that the bitcoin you received are genuine and your ownership is correctly recorded by all Bitcoin participants.But as with paper gold, the financialization of Bitcoin can start to become an issue if custodians hold it in ways that only rely on fractional reserves or rehypothecation.

Are all bitcoin equal?

Bitcoin has all these groundbreaking attributes, yet they apply only to “real” bitcoin. But what are real bitcoin?

Are bitcoin under your full control real? Obviously.

As a bearer asset by nature, it’s best to hold your own bitcoin. Only then can you verify all-important attributes yourself without relying on a trusted third party. You know your bitcoin are genuine, and nobody can deny you access to them. These are the real deal.

Are bitcoin on an exchange real?

When you hold your bitcoin on an exchange, you don’t really control them. You have an IOU against the exchange, which promises to give them back to you in the future. But are these bitcoin real, as in “they have the unique attributes described above” like scarcity and verifiability?

- You can’t verify your bitcoins because you don’t hold specific bitcoins. All you have is a claim on an overall amount, so you’re delegating verification to the exchange. While it’s in the best interest of the exchange to make sure they don’t accept non-genuine bitcoin, they might have their own agenda when it comes to consensus rules (e.g., being sympathetic to perpetual inflation or raising the block size limit).

Further reading: We need Bitcoin full nodes. Economic ones. - You can’t enforce scarcity because an exchange can easily run on fractional reserves, taking in deposits and then using these funds to generate profits (e.g., trading themselves or lending it out). It’s possible to provide “proof of reserves”, but most exchanges don’t bother.

There are many additional advantages when you’re holding your bitcoin yourself that you voluntarily give up when using a third-party custodian. We name a few in our recent article Bitcoin on exchanges: Convenient, but not a great idea!

Are bitcoin in a financial product like an ETF real?

There’s a lot of excitement around Bitcoin Exchange Traded Funds (ETFs) because these could make holding “bitcoin” even easier for institutional investors, pension funds, and other highly regulated entities. Financial products like ETFs, futures contracts, or mutual funds allow the traditional finance world to gain some Bitcoin price exposure. But it’s mainly about mirroring the price, with only some faint echoes of real bitcoin. With these financial products, you don’t even have the option to withdraw the underlying bitcoin.

The decoupling of “real” bitcoin and “paper” bitcoin has adverse second-order effects. For example, assets on paper can create a fake supply for real demand, indirectly increasing the total bitcoin supply and suppressing the real market value.

But it gets even worse, as Caitlin Long, founder of the Bitcoin-focused Avanti Bank & Trust, recently laid out on Twitter. Because an inflated supply of Bitcoin causes the price to drop, the real demand also drops, leading to further price drops. Overall, every additional third party that runs on a fractional reserve might just be an extra burden on overall Bitcoin price discovery.

If this starts to sound like a problem that gold already has, you’re absolutely right! Gold already has a vast discrepancy between paper gold and the physical asset that’s supposed to back it. And we see bitcoin heading in the same direction.

Protecting Bitcoin (and yourself)

The “Proof of Keys” celebration is an initiative that tries to push back against the heavy financialization of Bitcoin. Trace Mayer initiated it on January 3rd, 2019, the 10th anniversary of the Bitcoin genesis block, and it occurs now every year on that specific date:

“We’re going to withdraw all of our bitcoin from any third-party services just to prove that they’re there. It’s either on the blockchain or it didn’t happen.”

Everybody withdrawing their funds from custodians at the same time? This sounds like a “bank run”, a race to get deposits out of a bank due to the fear that it might become insolvent. Luckily, if this happens regularly, it might never come to the point where institutions topple, as they know well in advance that bitcoiners don’t take lightly to false promises and fractional reserve banking. The goal is to keep these third parties in check and strengthen the overall resilience of the Bitcoin ecosystem.

So how can you make sure that you own the best possible bitcoin? That’s simple: take them into your own custody.

It’s a good feeling to actually own your bitcoin. It’s essential to establish best practices on how to withdraw your funds, take ownership and secure your own keys early on when you’re not under pressure.

Keeping your bitcoin secure doesn't have to be hard

The key to true bitcoin ownership is to do it securely. How to do that depends on the overall amount. But when you’re serious about Bitcoin, sooner or later, there’s no way around a hardware wallet.

Use a hardware wallet

A secret digital key is surprisingly hard to secure on a general-purpose device connected to the internet. One mistake and your keys (and bitcoin) can be gone. So a single-purpose device that generates and secures your private keys, and will never reveal them to any other device, comes in very handy. In a recent blog post, we wrote more about the pros and cons of different wallet types and why using a combination of mobile software wallet and hardware wallet is a good idea.

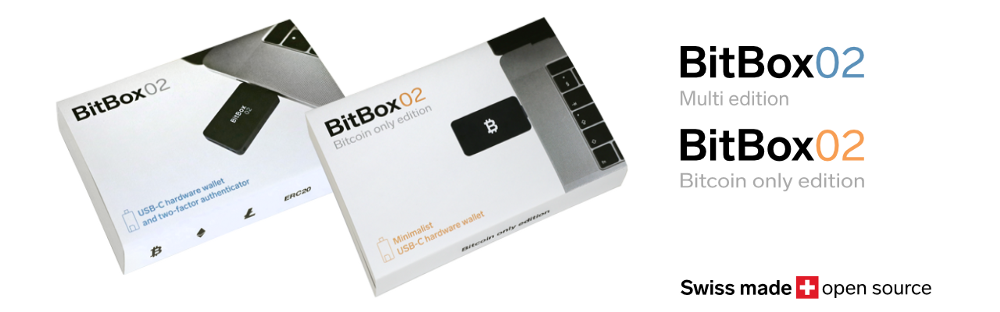

The BitBox02 is a great Bitcoin-only choice

When evaluating what hardware wallet to use, the BitBox02 should be on your list:

- The BitBox02 is one of the most accessible Bitcoin hardware wallets for beginners.

- It pioneers a unique security architecture that allows combining fully open-source software (for trust-minimization) with security hardening through a secure chip (for protection against physical device attacks).

- It’s available as Bitcoin-only with radically focused firmware (less code means less attack surface).

Check out our full comparison table of the BitBox02 against other common hardware wallets.

Now: get your coins!

Follow our example guide on how to withdraw your bitcoin securely from an exchange like Kraken to your own BitBox02.

The most crucial step is to verify that the exchange’s withdrawal address matches the address shown on your BitBox02 hardware wallet.

Don’t own a BitBox yet?

Keeping your crypto secure doesn't have to be hard. The BitBox02 hardware wallet stores the private keys for your cryptocurrencies offline. So you can manage your coins safely.

The BitBox02 also comes in Bitcoin-only version, featuring a radically focused firmware: less code means less attack surface, which further improves your security when only storing Bitcoin.

Shift Crypto is a privately-held company based in Zurich, Switzerland. Our team of Bitcoin contributors, crypto experts, and security engineers builds products that enable customers to enjoy a stress-free journey from novice to mastery level of cryptocurrency management. The BitBox02, our second generation hardware wallet, lets users store, protect, and transact Bitcoin and other cryptocurrencies with ease—along with its software companion, the BitBoxApp.